杭州望崖阁2022年-2023届书法高考培训班招生简章 望崖阁书法高考培训工作室创办于2008年,遵循中国美术学院教学模式,针对全国各大招收书法本科的高校,制定...

2022年03月14日

杭州望崖阁2022年-2023届书法高考培训班招生简章

2022年02月22日

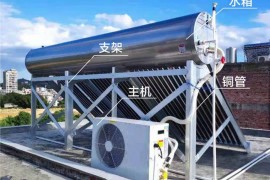

太空能热水器 第五代节能热水系统更节能更实用

太空能热水器 第五代节能热水系统更节能更实用 太空能热水器是由太阳能与空气能双动力合二为一组成。在有太阳的时候,充分利用太阳能吸热加热热水;在没有太阳的时候,空...

2022年02月15日

油茶籽油是什么?为什么要吃它?

油茶籽油是什么?为什么要吃它? 油茶籽油是我国特有的一种珍贵天然木本植物油;在民间,它还有很多动听的名字,如“长寿油”、“月子油”、“贡油”,现在越来越多的人在...

2021年10月30日

N站(Niconico)www.nicovideo.jp

N站(Niconico)www.nicovideo.jp NICONICO动画(Nico Nico Douga,简称N站)是日本一个联机弹幕影片分享网站。与类似...

2020年09月19日

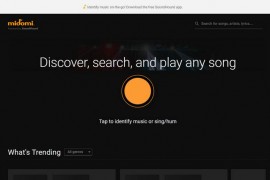

MidoMi-音乐搜索引擎:www.midomi.com

MidoMi-音乐搜索引擎: http://www.midomi.com MidoMi:基于声音的音乐搜索引擎是一个可以通过声音来搜索你想要的音乐的搜索引擎网站...

2020年06月27日

RoyalMail:英国皇家邮政官方网站:www.royalmail.com

RoyalMail:英国皇家邮政官方网站:http://www.royalmail.com/ RoyalMail:英国皇家邮政是英国规模最大的企业之一,承担英国...

2020年05月27日

英国广播公司BBC官方网站:www.bbc.com

英国广播公司BBC官方网站:http://www.bbc.com/ 英国广播公司(BBC),成立于1922年,是英国最大的新闻广播机构,也是世界最大的新闻广播机...

2020年04月27日

Receive Sms:在线国外手机号接收短信:www.receive-sms.com

Receive Sms:在线国外手机号接收短信:http://www.receive-sms.com/ Receive Sms:在线国外手机号接收短信是一个支持...

2024年08月04日

西南交通大学远程与继续教育学院:www.xnjd.cn

西南交通大学远程与继续教育学院网址: http://www.xnjd.cn 西南交通大学远程与继续教育学院简报:西南交通大学网络教育学院,西南交通大学成人教育学...

2022年11月02日

鸠摩搜书(鸠摩搜书官网,鸠摩搜书网页)

鸠摩搜书(鸠摩搜书官网,鸠摩搜书网页) 鸠摩搜索以非人工检索方式、自动生成到第三方网站的链接,以便用户能够找到和使用第三方网站上各种文档、学习资料、购买链接及其...

2022年10月17日

时秒侠:shimiaoxia.xyz

时秒侠:shimiaoxia.xyz 时秒侠是江建波的旗下论坛产品。 它每天24小时更新,汇集了时秒侠的新鲜,热门和有趣的内容。 所有您感兴趣的都在这里! 全新...

2022年10月11日

绅士动漫网-绅士漫画网:www.ssmh.cc

绅士动漫网-绅士漫画网: http://www.ssmh.cc 绅士漫画网-韩国漫画少女-神漫画免费在线为大家带来好看的韩国漫画少女免费在线观看,绅士漫画网是国...

2022年10月09日

百事达刻章网

百事达刻章网 www.bsdkz.vip 编辑:百事达刻章网 ...

2022年03月16日

中科CMA检测中心:www.cas-test.org

中科CMA检测中心:http://www.cas-test.org/ 中科检测是中科院旗下独立第三方检测机构,CMA检测中心,检测公司,环评公司,为全国企业及机...

2022年01月10日

仿真树实力工厂:www.tmcomii.com

仿真树实力工厂:http://www.tmcomii.com 东莞广晟景观,12年专业从事仿真,人造,水泥,玻璃钢,假树,仿真树,假树,人造树,仿真榕树,仿真椰...

2021年12月05日

空气能热水工程-深圳热水工程公司:www.szkepao.com

深圳市科跑科技有限公司1997年成立于深圳。2006年,开始专门从事节能加热设备的研发、设计、生产、推广普及、销售、服务;以及现场的使用设计、智能化控制,科学化...

2021年11月28日

徐州空气能冷暖、热水工程-展程新能源:www.xzzcxny.com

徐州空气能冷暖、热水工程-展程新能源:http://www.xzzcxny.com/ 徐州展程新能源承接热水工程,太阳能热水工程,空气能热水工程,宾馆热水工程,...

2021年11月27日

徐州空气能-徐州太阳能-徐州热水系统:www.taiyangnenggc.com

徐州空气能-徐州太阳能-徐州热水系统:http://www.taiyangnenggc.com/ 徐州浩群太阳能销售有限公司创建于2010年,公司一直专注于新能...

2020年06月28日

奇迹秀-因设计·而美丽:www.qijishow.com

奇迹秀-因设计·而美丽:http://www.qijishow.com/ 奇迹秀是一个公益组织,为设计师提供设计干货及资源,站内所有收集的资源都能免费下载,且资...

2020年01月31日

中国黑光网-黑光摄影网:www.heiguang.com

黑光网_摄影_化妆-中国影楼行业门户。 中国影楼行业门户网站,中国人像摄影学会合作媒体,汇集中国影楼人才,提供摄影,化妆,影楼资讯、影楼摄影作品、摄影教程、摄影...

2020年01月31日

中华气功网:www.chinaqigong.com

中华气功网网址: http://www.chinaqigong.com 中华气功网简报:中华气功网,中华气功论坛,中华气功养生网,气功网,中国气功网,养生气功网...

2020年01月31日

中国法律图书馆网:www.law-lib.com

法律图书馆网址: http://www.law-lib.com/ 法律图书馆简报:法律图书馆,法律图书,中国法律图书馆,法律图书馆网,西湖法律图书馆,北京大学法...

2020年01月31日

找字网:www.zhaozi.cn

找字网网址: http://www.zhaozi.cn/ 找字网简报:找字体,找字网。 找字网, 找字网,您的字体管家!提供中英文原创字体在线预览,免费字体下载...

2022年11月16日

肉丁网,肉丁网首页,肉丁网手工制作

肉丁网,肉丁网首页,肉丁网手工制作 “肉丁网”是由大连创旗信息技术有限公司(以下简称“创旗公司”)推出的互联网应用服务网站,肉丁网是以个人为中心的服务,用户通过...

2022年11月15日

四虎在线-四虎网址-四虎网站-四虎影院

四虎在线-四虎网址-四虎网站-四虎影院 四虎提供视频资源播放类型的网站,四虎内容包括电影以及电视剧和动漫等,四虎网络上的视频都能观看。但是可惜的是四虎网站已经宣...

2022年11月14日

e绅士-e绅士网址-e绅士彩色仓库-e绅士官网app下载

e绅士-e绅士网址-e绅士彩色仓库-e绅士官网app下载 绅士仓库,专注分享acg动漫,e绅士,和谐区,cosplay等,您想要的资源,绅士仓库,绅士之庭,绅士...

2022年03月17日

爱心筹 – 已帮近60万大病家庭筹到救命钱-筹款多,到账快!

爱心筹 - 已帮近60万大病家庭筹到救命钱-筹款多,到账快! 爱心筹是病友社区慢友帮推出的大病筹款平台。大平台,可信赖,筹款多,到账快!1对1筹款顾问电话指导让...

2022年03月05日

大作-找灵感,用大作:www.bigbigwork.com

大作-找灵感,用大作:https://www.bigbigwork.com/ 大作是专为各行业设计师度身定制的设计灵感搜索引擎,聚合全球众多知名设计网站,例如P...

2021年12月10日

潜江电视台-潜江市广播电视台

潜江电视台-潜江市广播电视台 潜江市广播电视台是潜江市广播电视机构。 节目设置 1、广播节目(无线和有线) 2、电视节目:在电视公共频道的预留时段内插播当地新闻...